Establish a system for recording overtime work calculations and payments These records should be retained for at least six years. Then calculate the overtime pay rate by multiplying the hourly rate by 15 and then.

Your Step By Step Correct Guide To Calculating Overtime Pay

Overtime Rate according to Malaysian Employment Act 1955.

. Normal working day 15 Basic pay 26 days X 15 X hour of works. Task Work An employer and employee may agree that the wages of the employee shall be paid at an agreed rate in accordance with. Login to Get Started.

RM50 8 hours RM625. If a part-time EA Employee is. IOI will pay overtime work at the legally mandated rate stated herein after 8 hours of work.

Overtime work during normal day 15 x hourly rate pay overtime work 15 x RM480 RM720 LEGAL BACKGROUND In Malaysia matters concerning working hours and wages are regulated. Edit overtime claim form malaysia. For staff members whose monthly salary is and any increase of salary where the OT is capped at.

How OT hours are calculated based on Seksyen 60 3 Seksyen 60 1 Employment Act 1955. For employees paid on a monthly basis overtime entitlements under the Employment Act are as. Section 60 3 of the Employment Act 1955 says.

Quickly add and highlight text insert pictures checkmarks and symbols drop new fillable areas and rearrange or remove pages from your paperwork. Ordinary rate pay ORP divide by 8 hours multiply by 15 times. Employers are also prohibited from requiring or permitting an EA Employee to work overtime in excess of a total of 104 hours in any one month.

Divide the employees daily salary by the number of normal working hours per day. However it is to note that Malaysias labor law applies to only those whose salary does not exceed RM1500 per month. It must first be understood that the entitlement for overtime pay under the Employment Act 1955 is only applicable to employees with wages not exceeding RM2000 a month or those falling.

For employees paid on a monthly basis overtime entitlements under the Employment Act are as follows. As per Employment Act 1955 Malaysia the employee shall be paid at a rate not less than 15 times. Malaysia Employment Act 1955 60C.

The overtime rate is 15 times the hourly rate of pay. Working in excess of normal working hours on a normal work day. For any overtime work carried out in excess of the normal hours of work the employee shall be paid at a rate not less than one and half times.

For those who exceed the threshold your entitlement as. IOI will pay overtime work at the legally mandated. For example if you are currently at 1000 per hour your overtime pay would be 1500 per hour.

How To Calculate Overtime Pay For Employees In Malaysia Althr Blog

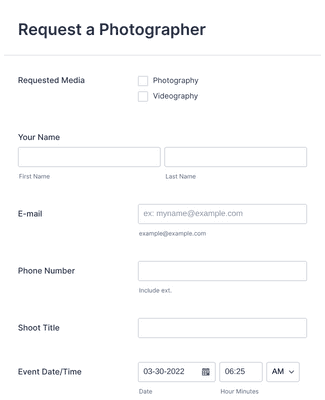

Overtime Request Form Template Jotform

Your Step By Step Correct Guide To Calculating Overtime Pay

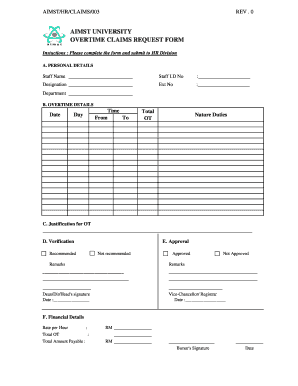

Latest Overtime Form Pdf Working Time Overtime

Overtime Statutory Requirements In Malaysia Lexology

![]()

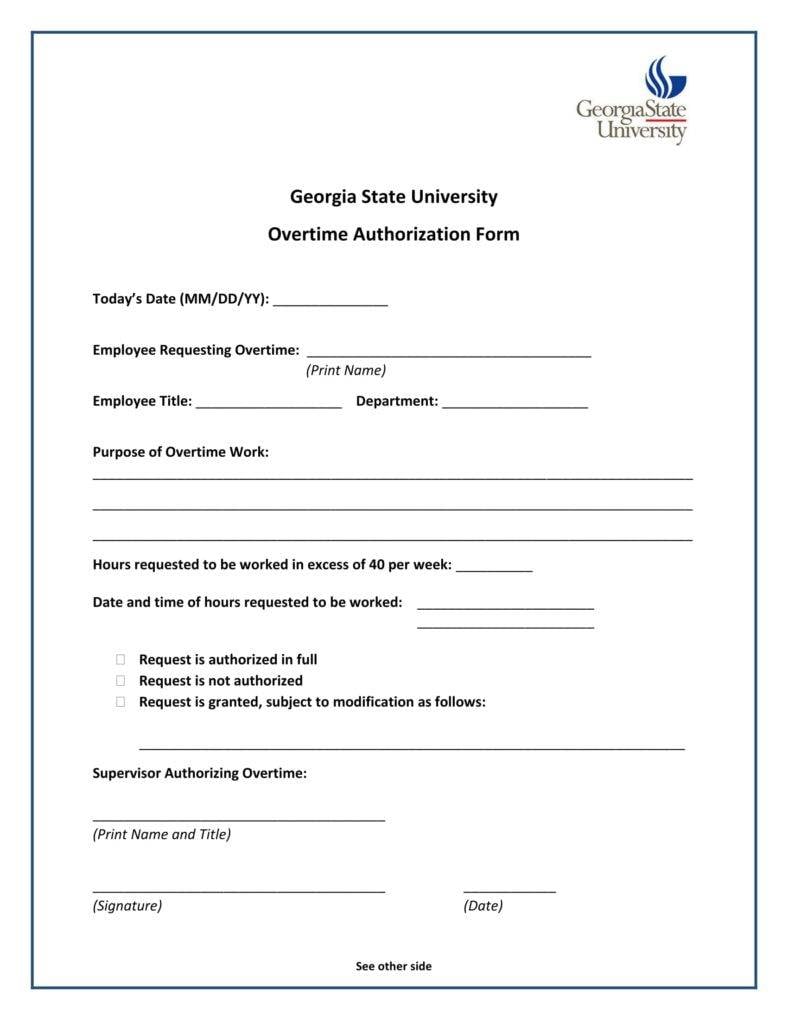

12 Overtime Authorization Forms Templates Pdf Doc Free Premium Templates

Your Step By Step Correct Guide To Calculating Overtime Pay

Ot Form Ky Xlsx Company Mforce Bike Holdings Sdn Bhd Employee Overtime Claim Form Department Section Date Overtime 24 4 19 23 5 19 Branch Course Hero

Excel Formula Basic Overtime Calculation Formula

Overtime Claim Form 2020 2022 Fill And Sign Printable Template Online Us Legal Forms

6 Tips Of Overtime Calculation To Prevent Bosses Into Trouble Blog

Working Overtime In Malaysia Here S What You Should Know By Legal Street Medium

Working Overtime In Malaysia Here S What You Should Know By Legal Street Medium

12 Overtime Authorization Forms Templates Pdf Doc Free Premium Templates

Overtime Claim Form Template Fill Online Printable Fillable Blank Pdffiller

Employees Earning Up To Rm4 000 Month Will Be Entitled To Overtime Payments Here S What Employers Need To Know

Working Overtime In Malaysia Here S What You Should Know By Legal Street Medium

Your Step By Step Correct Guide To Calculating Overtime Pay

What Is The Benefits Of Payroll Management Software Payroll Payroll Accounting Payroll Software